From Wikipedia, the free encyclopedia

Usury (pronounced /ˈjuːʒəri/, from Medieval Latin usuria, "interest", or from Latin usura, "interest") originally was the charging of interest on loans; this included charging a fee for the use of money, such as at a bureau de change. In places where interest became acceptable, usury was interest above the rate allowed by law. Today, usury commonly is the charging of unreasonable or relatively high rates of interest. The term is largely derived from Christian religious principles; Riba is the corresponding Arabic term and ribbit is the Hebrew word.The pivotal change in the English-speaking world seems to have come with the permission to charge interest on lent money: particularly the 1545 act "An Acte Agaynst Usurie" (37 H.viii 9) of King Henry VIII of England (see book references).

Contents[hide] |

[edit] Historical meaning

| | This article's tone or style may not be appropriate for Wikipedia. Specific concerns may be found on the talk page. See Wikipedia's guide to writing better articles for suggestions. (March 2010) |

Main articles: History of banking and History of pawnbroking

Banking during Roman times was different from modern banking. During the Principate, most banking activities were conducted by private individuals, not by such large banking firms as exist today; almost all moneylenders in the Empire were private individuals, because anybody that had any additional capital and wished to lend it out, could easily do so.[1]The rate of interest on loans varied in the range of 4–12 percent; but, when the interest rate was higher, it typically was not 15–16 percent but either 24 percent or 48 percent. The apparent absence of intermediary rates suggests that the Romans may have had difficulty calculating rates. They quoted them on a monthly basis, as in the loan described here, and the most common rates were multiples of twelve. Monthly rates tended to range from simple fractions to 3–4 percent, perhaps because lenders used Roman numerals.[2]

Moneylending during this period was largely a matter of private loans advanced to persons short of cash, whether persistently in debt or temporarily until the next harvest. Mostly, it was undertaken by exceedingly rich men who were prepared to take on a high risk if the profit looked good; interest rates were fixed privately and were almost entirely unrestricted by law. Investment was always regarded as a matter of seeking personal profit, often on a large scale. Banking was of the small, back-street variety, run by the urban lower-middle class of petty shop-keepers. By the 3rd century, acute currency problems in the Empire drove them into decline.[3] The rich who were in a position to take advantage of the situation became the money-lenders when the ever-increasing tax demands in the last declining days of the Empire crippled and eventually destroyed the peasant class by reducing tenant-farmers to serfdom. It was evident that usury meant exploitation of the poor.[4]

The First Council of Nicaea, in 325, forbade clergy from engaging in usury[5] (canon 17). At the time, usury was interest of any kind, and the canon merely forbade the clergy to lend money on interest above 1 percent per month (12.7% APR). Later ecumenical councils applied this regulation to the laity.[5][6]

Lateran III decreed that persons who accepted interest on loans could receive neither the sacraments nor Christian burial.[7] Pope Clement V made the belief in the right to usury a heresy in 1311, and abolished all secular legislation which allowed it.[8] Pope Sixtus V condemned the practice of charging interest as "detestable to God and man, damned by the sacred canons and contrary to Christian charity."[8]

Theological historian John Noonan argues that "the doctrine [of usury] was enunciated by popes, expressed by three ecumenical councils, proclaimed by bishops, and taught unanimously by theologians."[6]

Certain negative historical renditions of usury carry with them social connotations of perceived "unjust" or "discriminatory" lending practices. The historian Paul Johnson, comments:

The Hebrew Bible regulates interest taking. Interest can be charged to strangers but not between those who are close to each other.Most early religious systems in the ancient Near East, and the secular codes arising from them, did not forbid usury. These societies regarded inanimate matter as alive, like plants, animals and people, and capable of reproducing itself. Hence if you lent 'food money', or monetary tokens of any kind, it was legitimate to charge interest.[9] Food money in the shape of olives, dates, seeds or animals was lent out as early as c. 5000 BC, if not earlier. ...Among the Mesopotamians, Hittites, Phoenicians and Egyptians, interest was legal and often fixed by the state. But the Jews took a different view of the matter.[10]

Israelites were forbidden to charge interest on loans made to other Israelites, but allowed to charge interest on transactions with non-Israelites, as the latter were often amongst the Israelites for the purpose of business anyway, but in general, it was seen as advantageous to avoid getting into debt at all to avoid being bound to someone else. Debt was to be avoided and not used to finance consumption, but only when in need. However, the laws against usury were among the many which the prophets condemn the people for breaking.[12]Deuteronomy 23:19 Thou shalt not lend upon interest to thy brother: interest of money, interest of victuals, interest of any thing that is lent upon interest. Deuteronomy 23:20 Unto a foreigner thou mayest lend upon interest; but unto thy brother thou shalt not lend upon interest; that the LORD thy God may bless thee in all that thou puttest thy hand unto, in the land whither thou goest in to possess it.[11]

Johnson contends that the Torah treats lending as philanthropy in a poor community whose aim was collective survival, but which is not obliged to be charitable towards outsiders.

Usury (in the original sense of any interest) was at times denounced by a number of religious leaders and philosophers in the ancient world, including Plato, Aristotle, Cato, Cicero, Seneca,[14] Aquinas,[15] Muhammad,[16] Moses,[citation needed] Philo[citation needed] and Gautama Buddha[citation needed].[17]A great deal of Jewish legal scholarship in the Dark and the Middle Ages was devoted to making business dealings fair, honest and efficient.[13]

For example, Cato in his De Re Rustica said:

But one must always consider that usury, in historical context, has always been inextricably linked to economic abuses, mostly of the masses and of the poor; but sometimes of the financier and royalty, as bankrupt royalty has led to many a demise, thus frowning upon lending at interest or for a euphemistic "just profit"[clarification needed]. The main moral argument is that usury creates excessive profit and gain without "labor" which is deemed "work" in the Biblical context. Profits from usury are argued not to arise from any substantial labor or work but from mere avarice, greed, trickery and manipulation. In addition, usury is said to create a divide between people due to obsession with monetary gain. Most importantly, usury is the derivation of profit from biological time, which is linked to life, considered sacred, God-given and divine, leading to excessive worrying about money instead of God, thus subjugating a God-given sanctity of life to man-made artificial notions of material wealth."And what do you think of usury?" — "What do you think of murder?"

Interest of any kind is forbidden in Islam. As such, specialized codes of banking have developed to cater to investors wishing to obey Qur'anic law. (See Islamic banking)

As the Jews were ostracized from most professions by local rulers, the church and the guilds, they were pushed into marginal occupations considered socially inferior, such as tax and rent collecting and moneylending. Natural tensions between creditors and debtors were added to social, political, religious, and economic strains.[18]

Peasants were forced to pay their taxes to Jews who were economically coerced into becoming the "front men" for the lords. The Jews would then be identified as the people taking their earnings. Meanwhile the peasants would remain loyal to the lords....financial oppression of Jews tended to occur in areas where they were most disliked, and if Jews reacted by concentrating on moneylending to non-Jews, the unpopularity — and so, of course, the pressure — would increase. Thus the Jews became an element in a vicious circle. The Christians, on the basis of the Biblical rulings, condemned interest-taking absolutely, and from 1179 those who practiced it were excommunicated. Catholic autocrats frequently imposed the harshest financial burdens on the Jews. The Jews reacted by engaging in the one business where Christian laws actually discriminated in their favor, and became identified with the hated trade of moneylending.[19]

In England, the departing Crusaders were joined by crowds of debtors in the massacres of Jews at London and York in 1189–1190. In 1275, Edward I of England passed the Statute of Jewry which made usury illegal and linked it to blasphemy, in order to seize the assets of the violators. Scores of English Jews were arrested, 300 were hanged and their property went to the Crown. In 1290, all Jews were expelled from England, and allowed to take only what they could carry; the rest of their property became the Crown's. The usury was cited as the official reason for the Edict of Expulsion. However, not all Jews were expelled: it was easy to convert to Christianity and thereby avoid expulsion. Many other crowned heads of Europe expelled the Jews, although again conversion to Christianity meant that you were no longer considered a Jew (see the articles on marranos or crypto-Judaism).

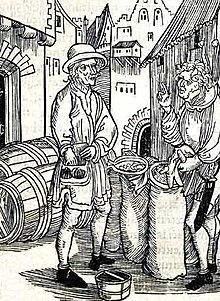

The growth of the Lombard bankers and pawnbrokers, who moved from city to city along the pilgrim routes, was important for the development of trade and commerce.

Die Wucherfrage is the title of a Lutheran Church - Missouri Synod work against usury from 1869. Usury is condemned in 19th century Missouri Synod doctrinal statements.[20]

The papal prohibition on usury meant that it was a sin to charge interest on a money loan. As set forth by Thomas Aquinas, the natural essence of money was as a measure of value or intermediary in exchange. The increase of money through usury violated this essence and according to the same Thomistic analysis, a just transaction was one characterized by an equality of exchange, one where each side received exactly his due. Interest on a loan, in excess of the principal, would violate the balance of an exchange between debtor and creditor and was therefore unjust.

Some have suggested that the development of double entry bookkeeping would provide a powerful argument in favor of the legitimacy and integrity of usury but this is an obvious non-sequitur. Business has always been accepted as a right and proper activity [21] by all cultures, including those that reject usury.

[edit] Religious context

[edit] The Old Testament

From the King James Version[Exodus 22:25] If thou lend money to any of my people that is poor by thee, thou shalt not be to him as an usurer, neither shalt thou lay upon him usury.

[Leviticus 25:36] Take thou no usury of him, or increase: but fear thy God; that thy brother may live with thee.

[Leviticus 25:37] Thou shalt not give him thy money upon usury, nor lend him thy victuals for increase.

[Deuteronomy 23:19] Thou shalt not lend upon usury to thy brother; usury of money, usury of victuals, usury of any thing that is lent upon usury:

[Deuteronomy 23:20] Unto a stranger thou mayest lend upon usury; but unto thy brother thou shalt not lend upon usury: that the LORD thy God may bless thee in all that thou settest thine hand to in the land whither thou goest to possess it.

[edit] Torah

Main article: Loans and interest in Judaism

The following quotations are from the Hebrew Bible, 1917 Jewish Publication Society translation:If thou lend money to any of My people, even to the poor with thee, thou shalt not be to him as a creditor; neither shall ye lay upon him interest. (Exodus, 22:25)[22]

And if thy brother be waxen poor, and his means fail with thee; then thou shalt uphold him: as a stranger and a settler shall he live with thee. Take thou no interest of him or increase; but fear thy God; that thy brother may live with thee. Thou shalt not give him thy money upon interest, nor give him thy victuals for increase. (Leviticus, 25:35-37)

Thou shalt not lend upon interest to thy brother: interest of money, interest of victuals, interest of any thing that is lent upon interest. Unto a foreigner thou mayest lend upon interest; but unto thy brother thou shalt not lend upon interest; that the Lord thy God may bless thee in all that thou puttest thy hand unto, in the land whither thou goest in to possess it. (Deuteronomy, 23:20-21)

[edit] New Testament

Christ drives the Usurers out of the Temple, a woodcut by Lucas Cranach the Elder in Passionary of Christ and Antichrist.[23]

Finally the master said to him 'Why then didn't you put my money on deposit, so that when I came back, I could have collected it with interest?'

Consider the parable of the talents from the paradigm that Jesus could not and did not change God's law on usury but instead upheld it. Note first that, in addition to accusing the nobleman (who represented Jesus) of being an austere or hard man, the wicked servant also accused him of taking up what he had not laid down and reaping what he had not sown. In other words, the servant had accused his master of being a thief. On this point, he accuses the master of being a thief, or at least an unscrupulous exploiter. Immediately following these false accusations, the master responded:"Thou oughtest therefore to have put my money to the exchangers, and then at my coming I should have received mine own with usury."

The master declared the wicked servant would be judged by his own standard. Because this wicked servant considered his master a thief, the very least he could have done was earn for his master in the easiest possible way, by putting his money in a bank that paid usury."…Out of thine own mouth will I judge thee, thou wicked servant. Thou knewest that I was an austere man, taking up that I laid not down, and reaping that I did not sow. Wherefore then gavest not thou my money into the bank, that at my coming I might have required mine own with usury?"

On the other hand Luke 6:35 says "But love ye your enemies, and do good, and lend, hoping for nothing again; and your reward shall be great".

Jesus referred to wealth as a hindrance to entering the Kingdom of Heaven.

[edit] Qur'an

Main article: Riba

The following quotations are from the Qur'an:Those who charge usury are in the same position as those controlled by the devil's influence. This is because they claim that usury is the same as commerce. However, God permits commerce, and prohibits usury. Thus, whoever heeds this commandment from his Lord, and refrains from usury, he may keep his past earnings, and his judgment rests with God. As for those who persist in usury, they incur Hell, wherein they abide forever (Al-Baqarah 2:275)

God condemns usury, and blesses charities.God dislikes every disbeliever, guilty. Lo! those who believe and do good works and establish worship and pay the poor-due, their reward is with their Lord and there shall no fear come upon them neither shall they grieve. O you who believe, you shall observe God and refrain from all kinds of usury, if you are believers. If you do not, then expect a war from God and His messenger. But if you repent, you may keep your capitals, without inflicting injustice, or incurring injustice. If the debtor is unable to pay, wait for a better time. If you give up the loan as a charity, it would be better for you, if you only knew. (Al-Baqarah 2:276-280)

O you who believe, you shall not take usury, compounded over and over. Observe God, that you may succeed. (Al-'Imran 3:130)

And for practicing usury, which was forbidden, and for consuming the people's money illicitly. We have prepared for the disbelievers among them painful retribution. (Al-Nisa 4:161)

The usury that is practiced to increase some people's wealth, does not gain anything at God. But if people give to charity, seeking God's pleasure, these are the ones who receive their reward many fold. (Ar-Rum 30:39)

[edit] Scholastic theology

The first of the scholastics, Saint Anselm of Canterbury, led the shift in thought that labeled charging interest the same as theft. Previously usury was seen as a lack of charity.St. Thomas Aquinas, the leading theologian of the Catholic Church, argued charging of interest is wrong because it amounts to "double charging", charging for both the thing and the use of the thing. Aquinas said this would be morally wrong in the same way as if one sold a bottle of wine, charged for the bottle of wine, and then charged for the person using the wine to actually drink it. Similarly, one cannot charge for a piece of cake and for the eating of the piece of cake. Yet this, said Aquinas, is what usury does. Money is exchange-medium. It is used up when it is spent. To charge for the money and for its use (by spending) is to charge for the money twice. It is also to sell time since the usurer charges, in effect, for the time that the money is in the hands of the borrower. Time, however, is not a commodity that anyone can sell. (For a detailed discussion of Aquinas and usury, go to Thought of Thomas Aquinas).

This did not, as some think, prevent investment. What it stipulated was that in order for the investor to share in the profit he must share the risk. In short he must be a joint-venturer. Simply to invest the money and expect it to be returned regardless of the success of the venture was to make money simply by having money and not by taking any risk or by doing any work or by any effort or sacrifice at all. This is usury. St Thomas quotes Aristotle as saying that "to live by usury is exceedingly unnatural". Islam likewise condemns usury but allowed commerce (Al-Baqarah 2:275) - an alternative that suggests investment and sharing of profit and loss instead of sharing only profit through interests. Judaism condemns usury towards Jews, but allows it towards non-Jews. St Thomas allows, however, charges for actual services provided. Thus a banker or credit-lender could charge for such actual work or effort as he did carry out e.g. any fair administrative charges. The Catholic Church, in a decree of the Fifth Council of the Lateran, expressly allowed such charges in respect of credit-unions run for the benefit of the poor known as "montes pietatis".[24]

In the 13th century Cardinal Hostiensis enumerated thirteen situations in which charging interest was not immoral.[25] The most important of these was lucrum cessans (profits given up) which allowed for the lender to charge interest "to compensate him for profit foregone in investing the money himself." (Rothbard 1995, p. 46) This idea is very similar to Opportunity Cost. Many scholastic thinkers who argued for a ban on interest charges also argued for the legitimacy of lucrum cessans profits (e.g. Pierre Jean Olivi and St. Bernardino of Siena).

[edit] Other contexts

[edit] Usury in literature

In The Divine Comedy Dante places the usurers in the inner ring of the seventh circle of hell. (Showing how cultural attitudes have changed since the 14th century, the usurers' ring was shared only by the blasphemers and sodomites.)In the 16th century it was necessary for Shylock to convert to Christianity and forsake usury before he could be redeemed in the climax of The Merchant of Venice. Thomas Lodge's didactic tirade against London moneylenders, An Alarum against Usurers containing tried experiences against worldly abuses tried to incite the educated class against the harm usurers seemed to induce in their victims.

By the 18th century usury was more often treated as a metaphor than a crime in itself, so that Jeremy Bentham's Defense of Usury was not as shocking as it would have appeared two centuries earlier.

In the early 20th century Ezra Pound's anti-usury poetry was not primarily based on the moral injustice of interest but on the fact that excess capital was no longer devoted to artistic patronage, as it could now be used for capitalist business investment.[26]

[edit] Usury and the law

The Magna Carta commands, "If any one has taken anything, whether much or little, by way of loan from Jews, and if he dies before that debt is paid, the debt shall not carry usury so long as the heir is under age, from whomsoever he may hold. And if that debt falls into our hands, we will take only the principal contained in the note."[27]

In the United States, usury laws are state laws that specify the maximum legal interest rate at which loans can be made. Congress has opted not to regulate interest rates on purely private transactions, although it arguably has the power to do so under the interstate commerce clause of Article I of the Constitution.

Congress has opted to put a federal criminal limit on interest rates by the Racketeer Influenced and Corrupt Organizations Act (RICO) definitions of "unlawful debt" which make it a federal felony to lend money at an interest rate more than two times the local state usury rate and then try to collect that "unlawful debt".[28]

It is a federal offense to use violence or threats to collect usurious interest (or any other sort). Such activity is referred to as loan sharking, although that term is also applied to non-coercive usurious lending, or even to the practice of making consumer loans without a license in jurisdictions that require licenses.

[edit] Usury and royalties

Royalties are contractual obligations of the Issuer of the royalty, made for the benefit of the holder of the royalty. Royalties require the payment of an agreed percentage of revenue of the Issuer, for an agreed period of time. In the event a royalty is purchased from an Issuer, the future revenue upon which the royalty is based is unknown at the time of the original transaction. Therefore, the cumulative amount of the future royalty payments is also an unknown. Royalty payments are not interest and royalties expire without value at their maturity. To be usurious payments made and received for the use of funds must be considered interest for loaned funds which require repayment at the maturity of the loan. The value in gains by the use of the royalty should equal its payment value, excess cost or interest beyond its tangible value is illicit interest or usury.[edit] Usury and slavery in present day

While the practice of direct slavery is widely banned across the world, in some places debt-slavery is still practiced.[29] A debtor who is found unable to repay a loan can be placed in a state of debt-slavery, a situation where-by their life and labors are directed by the lender until the debt is considered repaid.[30] Usury is often a major part of extending this slavery, not uncommonly assisting in extending the debt-slavery onto the children of the debtor, thus making slaves of multiple generations and promoting child labor.[31] Another form of or name for this practice is debt bondage.Author Michael Rowbotham uses the term "debt-slavery" when defining aspects of debt-based monetary systems which require interest to complete the economy.[32]

[edit] Usury statutes in the United States

Each U.S. state has its own statute which dictates how much interest can be charged before it is considered usurious or unlawful.If a lender charges above the lawful interest rate, a court will not allow the lender to sue to recover the debt because the interest rate was illegal anyway. In some states (such as New York) such loans are voided ab initio[33]

However, there are separate rules applied to most banks. The U.S. Supreme Court held unanimously in the 1978 Marquette Nat. Bank of Minneapolis v. First of Omaha Service Corp. case that the National Banking Act of 1863 allowed nationally chartered banks to charge the legal rate of interest in their state regardless of the borrower's state of residence.[34] In 1980, because of inflation, Congress passed the Depository Institutions Deregulation and Monetary Control Act exempting federally chartered savings banks, installment plan sellers and chartered loan companies from state usury limits. This effectively overrode all state and local usury laws.[35][36] The 1968 Truth in Lending Act does not regulate rates, except in the cases of some mortgages, but it does require uniform or standardized disclosure of costs and charges.[37]

In the 1996 Smiley v. Citibank case, the Supreme Court further limited states' power to regulate credit card fees, extending the reach of the Marquette decision. The court held that the word "interest" used in the 1863 banking law included fees, and, therefore, that states could not regulate fees.[38]

Some members of Congress have tried to create a federal usury statute that would limit the maximum allowable interest rate, but the measures have not progressed. In July, 2010, the Dodd–Frank Wall Street Reform and Consumer Protection Act, was signed into law by President Obama. The act provides for a Consumer Financial Protection Agency to regulate some credit practices, but does not have an interest rate limit.[39]

[edit] Ethical arguments for usury

| | The neutrality of this article is disputed. Please see the discussion on the talk page. Please do not remove this message until the dispute is resolved. (January 2010) |

[edit] Freedom of trade

The primary ethical argument in defense of usury has been the argument of negative freedom against the "restraint of trade" since the borrower has voluntarily entered into the usury contract.[citation needed] Opponents note, however, that borrowers may be tricked into signing such contracts, assume there is a usury law cap on interest that does not exist, or be driven to accept such an interest rate out of necessity.[citation needed] At the same time however, except for related party transactions where feelings of compassion, guilt, etc., compel the lender to lend without interest, in un-related party transactions where neither the borrower nor the lender has any predetermined attachment to one another, there is no incentive for the lender to lend or for the borrower to repay the debt without usury.[edit] Investment

A practical argument for usury in welfare economics is that charging interest is essential to guiding the investment process, based on the claim that profits are required to direct investments to their most productive use (solving the economic calculation problem). According to this argument, interest-driven investment is essential to economic growth, and therefore to the very existence of industrial civilization. This practical argument for the utility of usury treats all "unearned" returns to capital as interest; traditionally, guaranteed interest is usurious, whereas dividends from shared ventures are less so. In this tradition, the practical case against usury does not completely apply (although replacing debt market investments with stock market savings may not always be desirable). Officially, this is how capitalist Islamic states solve the calculation problem. An example of the 'moral' difference between dividend income and interest income is found in The Merchant of Venice: Shylock lends Antonio money for trade speculation, demanding repayment in flesh should Antonio's project fail utterly (accepting none of the business risk).[edit] Excessive rates

In addition to the defense of interest as such, the practice of charging high interest rates is defended by those who point out that such rates reflect the very fact that the loans are being given to creditors with a high risk of default (in a competitive debt market the interest spread simply covers the credit risk). Economists of the Austrian school say that there is no such thing as a "just" interest rate separate from the free market equilibrium determined by the time-preferences of individual lenders and debtors. (Other free market theorists take a similar view on the merit of an unregulated debt market, but may not explain the subjective estimate of a worthwhile interest-rate bargain through time preference.)[edit] Adverse selection and enforcement methods

Some have defended the threat or use of force (legal or illegal) against non-payers (such as required by Shylock). This position is based on the idea that without force there will be a market failure—since very high interest loans will only be taken up by those intending to default. The need for enforcement stems from this adverse selection problem rather than any immorality inherent in moneylenders. See: "The market for lemons".Today's credit reporting system in industrialized countries obviates much of the need for the use of force. Since all potential lenders can quickly learn of one's delinquent status, non-payers may find an unwilling seller for many important goods, like apartment rentals, mortgages, renting of expensive equipment without a deposit, and in many cases, insurance or employment. In the minds of many debtors, such considerations outweigh fear of force brought against them.[citation needed]

[edit] Charities

Some low-interest charity loans (such as small business micro-loans) defend interest-charging[citation needed] since it allows for the indefinite administration of the charity, the replacement of defaulted loans, and in some cases, the creation of additional loan pools in other regions. These people say that the final "ethical result" of the interest rates justifies the means of charging them.[citation needed][edit] Avoidance mechanisms and interest-free lending

[edit] Islamic banking

Main article: Islamic banking

In a partnership or joint venture where money is lent, the creditor only provides the capital yet is guaranteed a fixed amount of profit. The debtor, however, puts in time and effort, but is made to bear the risk of loss. Muslim scholars argue that such practice is unjust.[40] As an alternative to usury, Islam strongly encourages charity and direct investment in which the creditor shares whatever profit or loss the business may incur.

JAK is a bank free of usury.

[edit] Interest-free banks

The JAK members bank is a usury-free saving and loaning system.[edit] Interest-free micro-lending

Growth of the internet internationally has enabled global micro-lending charities where lenders make small sums of money available on zero-interest terms. Persons lending money to on-line micro-lending charity Kiva for example do not get paid any interest,[41] although the end users to whom the loans are made may be charged interest by Kiva's partners in the country where the loan is used.[42][edit] See also

- Abomination (Bible)

- Contractum trinius

- Loansharking (traditional occupation of Mafiosi)

- Money changing

- Payday loans

- Predatory lending

- Vix Pervenit

- Title loan

- Usury Act 1660

[edit] References

| | Constructs such as ibid. and loc. cit. are discouraged by Wikipedia's style guide for footnotes, as they are easily broken. Please improve this article by replacing them with named references (quick guide), or an abbreviated title. |

- ^ Zgur, Andrej: The economy of the Roman Empire in the first two centuries A.D., An examination of market capitalism in the Roman economy, Aarhus School of Business, December 2007, pp. 252–261.

- ^ Temin, Peter: Financial Intermediation in the Early Roman Empire, The Journal of Economic History, Cambridge University Press, 2004, vol. 64, issue 03, p. 15.

- ^ Young, Frances: Christian Attitudes to Finance in the First Four Centuries, Epworth Review 4.3, Peterborough, September 1977, p. 80.

- ^ Young, Frances: Christian Attitudes to Finance in the First Four Centuries, Epworth Review 4.3, Peterborough, September 1977, pp. 81–82.

- ^ a b Moehlman, 1934, p. 6.

- ^ a b Noonan, John T., Jr. 1993. "Development of Moral Doctrine." 54 Theological Stud. 662.

- ^ Moehlman, 1934, p. 6-7.

- ^ a b Moehlman, 1934, p. 7.

- ^ Johnson cites Fritz E. Heichelcheim: An Ancient Economic History, 2 vols. (trans. Leiden 1965), i.104-566

- ^ Johnson, Paul: A History of the Jews (New York: HarperCollins Publishers, 1987) ISBN 0-06-091533-1, pp. 172–73.

- ^ The Hebrew Bible in English according to the JPS 1917 Edition. http://www.mechon-mamre.org/e/et/et0523.htm

- ^ Examples of debt: I Samuel 22:2, II Kings 4:1, Isaiah 50:1. Prophetic condemnation of usury: Ezekiel 22:12, Nehemiah 5:7 and 12:13. Cautions regarding debt: Prov 22:7, passim.

- ^ Johnson, p. 272.

- ^ "Usury - The Root of All Evil". The Spirit of Now. Peter Russell. http://www.peterrussell.com/SP/Usury.php.

- ^ "Thomas Aquinas: On Usury, c. 1269-71". Fordham University. http://www.fordham.edu/halsall/source/aquinas-usury.html.

- ^ "The Prophet Muhammad's Last Sermon". Fordham University. http://www.fordham.edu/halsall/source/muhm-sermon.html.

- ^ Historical Critique of Usury

- ^ [1]

- ^ Johnson, p. 174.

- ^ Official Missouri Synod Doctrinal Statements

- ^ Carruthers, Bruce G., Espeland Wendy Nelson, Accounting for Rationality: Double-Entry Bookkeeping and the Rhetoric of Economic Rationality, American Journal of Sociology, Vol. 97, No. 1. (July 1991), pp. 38-40

- ^ "When you lend money to My people, to the poor person [who is] with you, you shall not behave toward him as a lender; you shall not impose interest upon him." (ORT translation with Rashi commentary)

- ^ The references cited in the Passionary for this woodcut: 1 John 2:14-16, Matthew 10:8, and The Apology of the Augsburg Confession, Article 8, Of the Church

- ^ "Session Ten: On the reform of credit organisations (Montes pietatis)". Fifth Lateran Council. Rome, Italy: Catholic Church. 1515-05-04. http://www.intratext.com/ixt/ENG0067/_PE.HTM. Retrieved 2008-04-05.

- ^ Roover, Raymond (Autumn 1967). "The Scholastics, Usury, and Foreign Exchang". Business History Review (The Business History Review, Vol. 41, No. 3) 41 (3): 257. doi:10.2307/3112192. http://jstor.org/stable/3112192.

- ^ http://www.englit.ed.ac.uk/studying/undergrd/american_lit_2/Handouts/cmc_pound.htm

- ^ Annotated English translation of 1215 version

- ^ 18 U.S.C. § 1961 (6)(B). See generally, Racketeer Influenced and Corrupt Organizations Act

- ^ http://www.antislavery.org/english/resources/reports/download_antislavery_publications/bonded_labour_reports.aspx

- ^ http://www.hrw.org/en/reports/2006/07/27/swept-under-rug

- ^ http://hir.harvard.edu/courting-africa/child-slavery

- ^ http://www.feasta.org/documents/feastareview/glynn.htm

- ^ NY Gen Oblig 5-501 et seq. and NY 1503.

- ^ Marquette Nat. Bank of Minneapolis v. First of Omaha Service Corp., 439 U.S. 299 (1978).

- ^ Usury rate limits Reference: Interest rate usury limits for U.S. states, 'Lectric Law Library.

- ^ The Effect of Consumer Interest Rate Deregulation on Credit Card Volumes, Charge-Offs, and the Personal Bankruptcy Rate, Federal Deposit Insurance Corporation "Bank Trends" Newsletter, March, 1998.

- ^ FDIC, Truth in Lending Act.

- ^ ABA Journal, March 2010, p. 59

- ^ ibid

- ^ Maududi(1967), vol. i, pg. 199

- ^ Kiva Faq: Will I get interest on my loan?: "Loans made through Kiva's website do not earn any interest. Kiva's loans are not an investment and are not recommended as an investment."

- ^ Kiva FAQ: Do Kiva.org's Field Partners charge interest to the entrepreneurs?: "Our Field Partners are free to charge interest, but Kiva.org will not partner with an organization that charges exorbitant interest rates."

[edit] Further reading

- 'In Restraint of Usury: the Lending of Money at Interest', Sir Harry Page, The Chartered Institute of Public Finance and Accounts, London, 1985,

- The Bibliography therein - particularly:

- 'The Idea of Usury: from Tribal Brotherhood to Universal Otherhood', Benjamin Nelson, 2nd Edition, University of Chicago Press, Chicago and London, 1949, enlarged 2nd edition, 1969.

- 'Interest and Inflation Free Money: Creating an Exchange Medium That Works for Everybody and Protects the Earth', Margrit Kennedy, with Declan Kennedy: Illustrations by Helmut Creutz; New and Expanded Edition, New Society Publishers, Philadelphia, PA, USA and Gabriola Island, BC, Canada, 1995.

[edit] External links

| Wikiquote has a collection of quotations related to: Usury |

| Look up usury in Wiktionary, the free dictionary. |

- Usury Laws by State (US)

- The History of Usury from Americans for Fairness in Lending

- Usury and the Church of England

- Global Islamic Finance & Commerce

- Usury is Riba in Islam, this is an exclusive site on the subject of Riba (ar-Riba, usury, interest), answering the logic and reasoning for the prohibition of usury

- USURY, A Scriptural, Ethical and Economic View, by Calvin Elliott, 1902. (a searchable facsimile at the University of Georgia Libraries; DjVu & layered PDF format)

- Catholic Encyclopedia article on Usury, 1912

- Question 78. The sin of usury (St Thomas Aquinas' Summa Theologiæ)

- Luther's Sermon on Trading and Usury

- Concordia Cyclopedia: Usury

- What Love Is This? A Renunciation of the Economics of Calvinism

- Dr. Ian Hodge on Usury

- S.C. Mooney's Response to Dr. Gary North's critique of Usury: Destroyer of Nations

- Norman Jones's article on usury from EH.NET's Encyclopedia

- Islamic definition of Usury

- Usury laws by state.

- History of Religious Injunctions Against Usury

- Origin of Modern Banking and Usury in Britain

- Buddha on Right Livelihood and Usury

- Usury (Jewish Encyclopedia, 1906 ed.)

- Usury (Beyond the Pale exposition, friends-partners.org)

- Defence of Usury by Jeremy Bentham. 1787

- Of Usury by Francis Bacon

- Thomas Geoghegan on "Infinite Debt: How Unlimited Interest Rates Destroyed the Economy"

http://en.wikipedia.org/wiki/Usury

No comments:

Post a Comment